Benefits of Keeping Separate Business and Personal Bank Accounts

As a new business owner it can be tempting to use one bank account for business and personal finances. At first it might seem like the easiest approach, but you’ll soon discover it’s not a good idea.

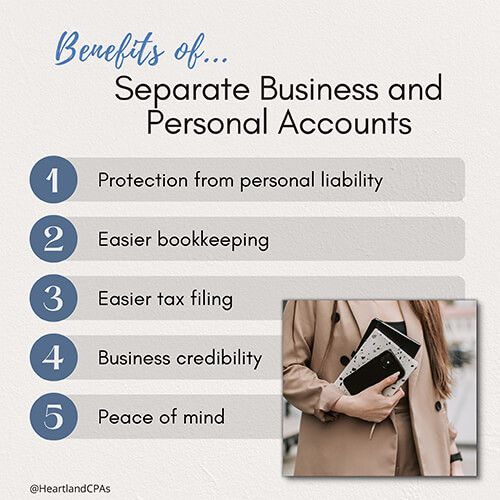

Here are 5 benefits of keeping your business and personal finances separate:

1) Protection from personal liability: Your personal finances won’t be at risk if the business is involved in any legal proceedings.

2) Easier bookkeeping: You won’t have to constantly search your account to find the relevant business transactions and gives a clearer view of your business cash flow.

3) Easier tax filing: It’s quicker to find the relevant information at tax time; you’ll be able to verify your business expenses and take advantage of tax deductions/credits.

4) Business credibility: Your business looks more credible and professional to clients and suppliers when your business name appears on transactions to and from the company.

5) Peace of mind: You’ll feel more confident and at peace knowing where your business stands financially.