Canadian Income Tax Brackets

Do you know how your income is taxed?

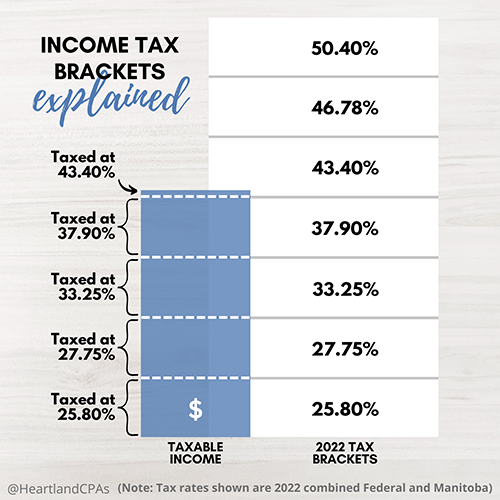

In Canada we have tax brackets that determine how much income tax you’ll pay each year. The more money you make, the more taxes you pay. But what many people don’t realize is that when your income increases and moves to a higher tax bracket, your entire income isn’t taxed at the higher rate. Only the amount of income that falls within each bracket is taxed at that corresponding tax rate. For example, if your taxable income just barely reaches into the next bracket, only that small portion of your income will be taxed at the higher rate. The rest of your income will be taxed at the lower rate(s).

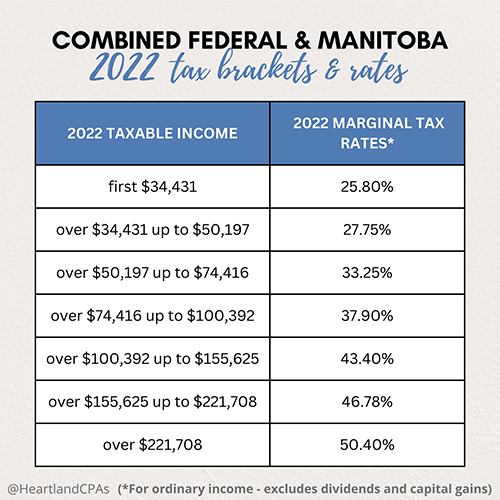

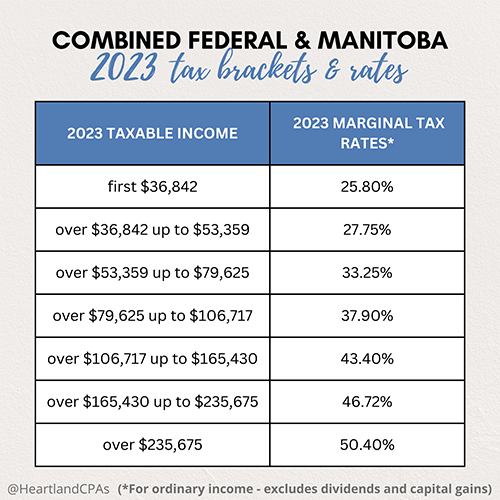

The 2022 and 2023 charts show the dollar amounts for each tax bracket. It can be helpful to know which tax bracket(s) your income falls under so you’ll be prepared for any changes to your income tax return and for financial planning purposes.